On November 5th, 2025, while everyone was panicking, we entered BTC at 99k.

It was the lowest point of the week, red candles everywhere, sentiment in shambles.

And today, we rotated out after a clean 7% gain.

Profits booked.

Capital moved back into alts.

That’s how we play this game.

You don’t wait for confirmation candles.

You buy into fear.

You buy into red.

The market rewards those who act when everyone else freezes.

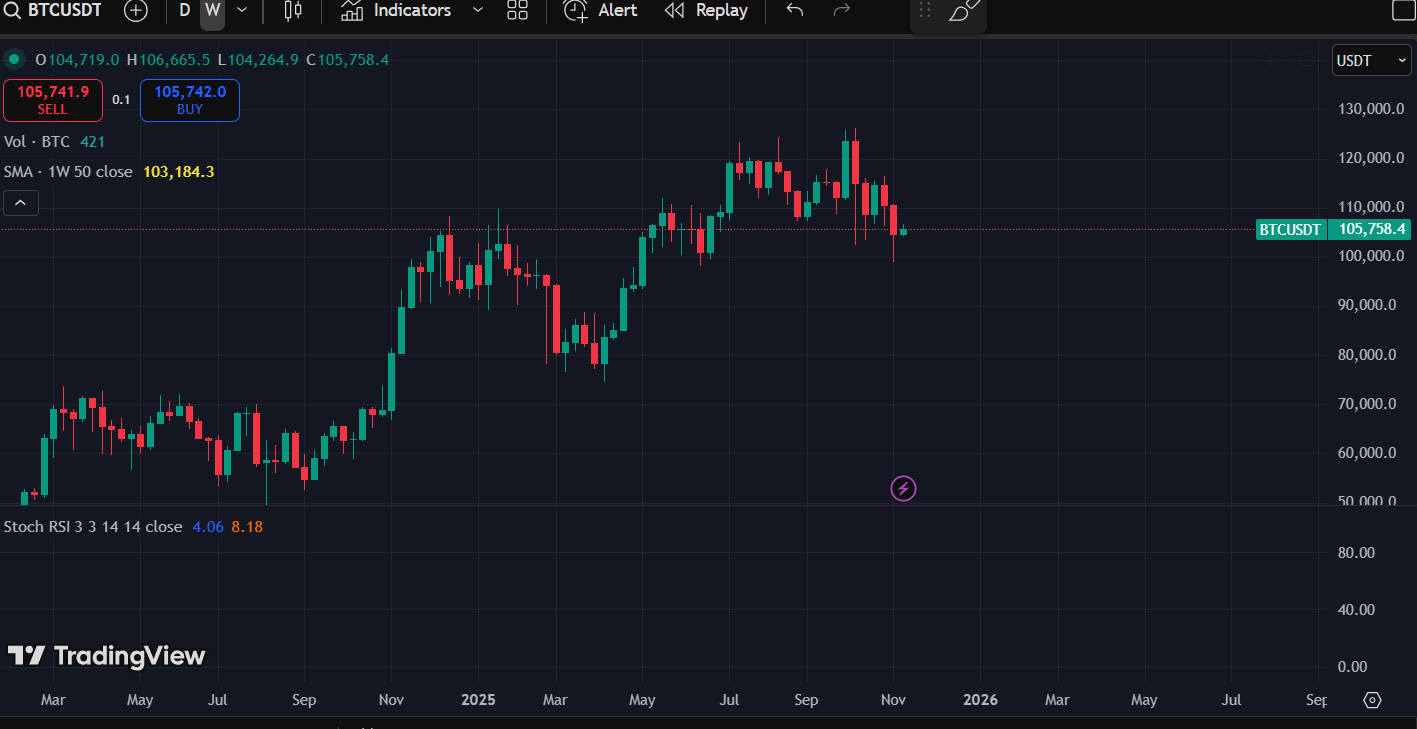

BTC: The Turning Point

Look closely at the weekly chart.

We just closed above the 50-week SMA, that yellow line that everyone ignores until it matters.

That’s your pivot.

Right now, we’re sitting at 105.8k, right on that crucial line.

Two possible scenarios from here:

1) If we close this week ABOVE the 50-week SMA, the bounce begins.

Momentum returns. Liquidity floods back.

2) If we close BELOW the 50-week SMA, then we wait.

If the next weekly candle also closes below, that confirms cycle exhaustion.

We’ll reassess, rebalance, and prepare for an extended consolidation phase.

But right now?

We’re still above it.

And with the government shutdown ending, volatility is guaranteed.

When governments reopen, money moves.

Liquidity repositions.

Narratives shift.

You think this was coincidence?

We bought 99k when everyone was screaming “cycle top.”

Now it’s 7% up, and the same people are wondering if it’s too late.

This is where market conviction separates you from the crowd.

We traded BTC long not because it was “safe,” but because it was necessary, a hedge against our ETH and SOL positions while the broader market reset.

That hedge just paid off.

Now we rotate those profits back into the ecosystem that moves faster, alts.

The Gold standard for AI news

AI keeps coming up at work, but you still don't get it?

That's exactly why 1M+ professionals working at Google, Meta, and OpenAI read Superhuman AI daily.

Here's what you get:

Daily AI news that matters for your career - Filtered from 1000s of sources so you know what affects your industry.

Step-by-step tutorials you can use immediately - Real prompts and workflows that solve actual business problems.

New AI tools tested and reviewed - We try everything to deliver tools that drive real results.

All in just 3 minutes a day

ETH: Momentum Rebuilding

ETH is setting up beautifully.

Weekly Stoch RSI curling up.

Daily? Curling too.

What else do you want?

This is what a bottom formation looks like, momentum flattening, pressure building, and structure holding.

ETH’s current level around 3.6k–3.7k sits right above Support (3.5k zone), the level I told you not to lose.

And we didn’t.

Volume is steady.

Buyers defending lows.

And that daily curl signals that the engine is warming again.

When BTC stabilizes above its 50-week, ETH tends to lead next.

This is how every rotation has played out for the last three cycles.

The setup’s identical.

Don’t sleep on it.

When ETH breaks 4.03k, you’ll start hearing “ETH season incoming.”

But by then, it’ll already be too late for fresh entries.

The move begins quietly, just like it did for BTC at 99k.

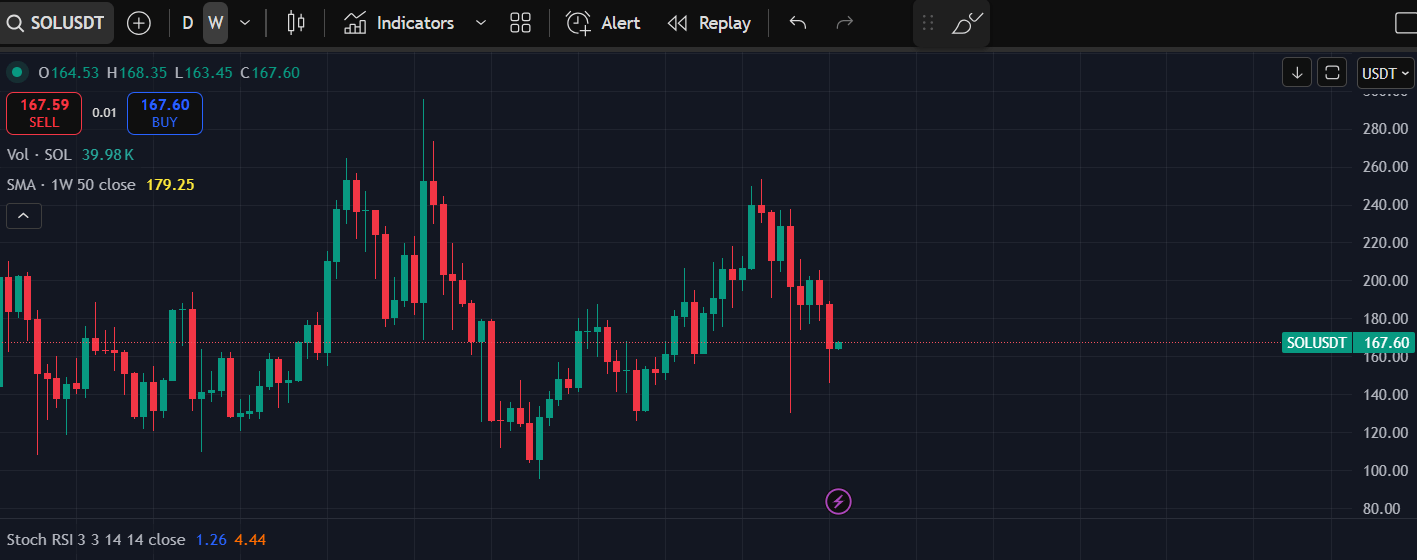

SOL: Patience Pays

While BTC stole attention, SOL has been quietly coiling.

Still holding above key supports.

Still in range.

Daily Stoch RSI curling up, weekly forming that base.

The same pattern you saw before every major expansion this year.

What does that tell you?

This isn’t weakness, it’s accumulation.

Everyone wants to chase green candles, but the real move begins from boredom.

The structure remains bullish until that breaks.

Remember: when BTC consolidates and ETH starts running, SOL follows violently.

The lag always turns into leadership once rotation flips.

And if you’ve been here long enough, you know, those 30–40% weeks come out of nowhere.

The Bigger Picture

The fear index sat at 32 last week.

Now it’s ticking higher.

That’s what happens before confidence returns.

Shutdown ending.

Macro warming up.

Momentum resetting.

These are foundations of a continuation phase, not a top.

You can feel it, the market’s been waiting for a signal to turn risk-on again.

And we just got one.

BTC holding 50W SMA.

ETH curling.

SOL basing.

Everything’s lining up exactly how we wanted it to.

My Take

I don’t trade emotion.

I trade structure.

We bought BTC red, sold BTC green, and rotated that capital back into ETH and SOL while everyone’s still frozen by last week’s volatility.

Now, we wait for confirmation.

Not hope.

Not hype.

Just confirmation.

If BTC closes above that SMA again this week, we ride.

If it doesn’t, we wait for the retest.

That’s what discipline looks like.

Don’t let this moment pass.

You saw me call 99k.

You saw the bounce.

You saw the rotation.

This is what preparation looks like in real time.

If you’re still hesitating, stop watching from the sidelines.

This cycle is rewarding those who act early, not those who think forever.

Join the 9-5 Traders Premium now.

$117/month gets you full access to my Altseason Playbook, Crypto Exit Manual, and private Discord trade breakdowns.

Price goes up soon.

You’ve seen the plays.

Now move before the next one starts without you.

Victor