On Sunday night, BTC pulled the same trick it’s been doing all month.

Went to bed with it down 2%, woke up, liquidity hunt.

Classic.

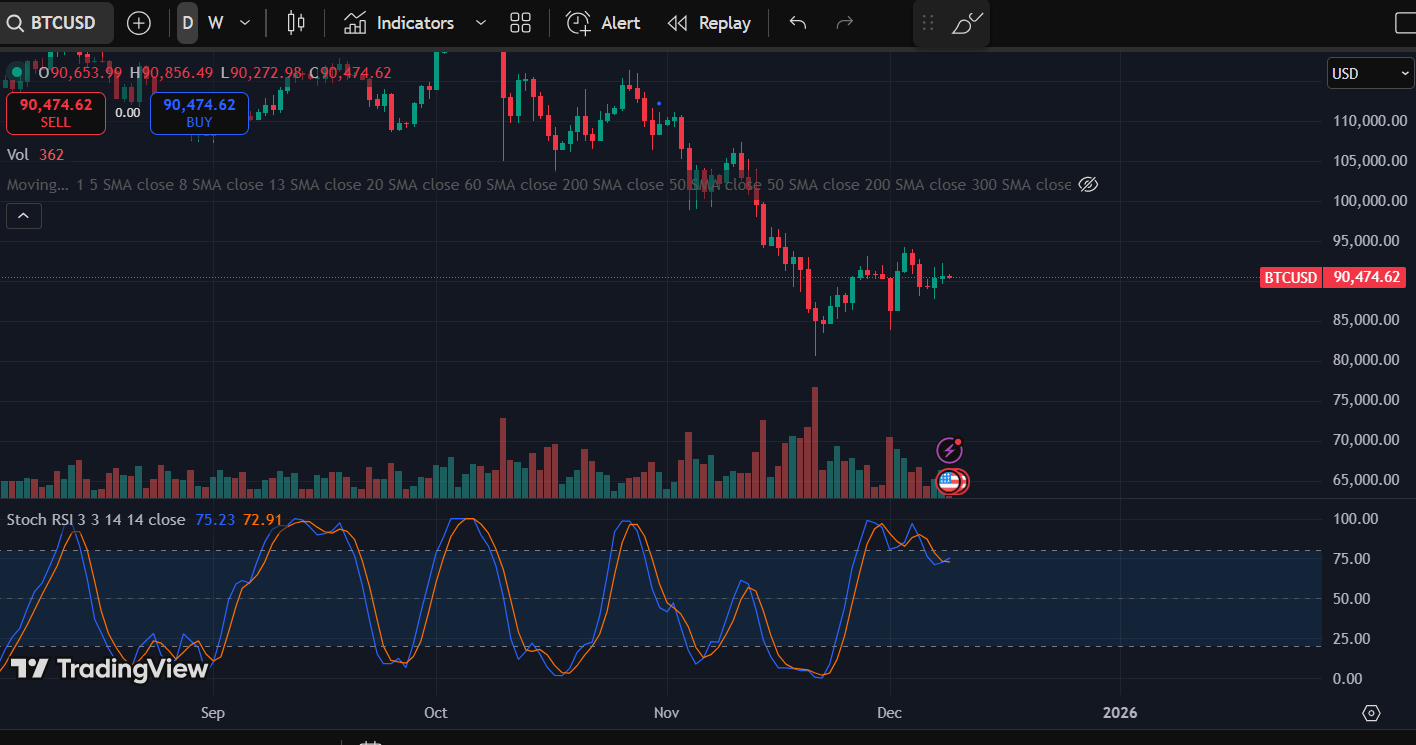

We’re back above 90k, holding steady, but let’s be real: the weekly close was a coin toss between bulls and bears.

It closed green, yes, but barely.

Essentially, we opened and closed the week at the same level.

That’s not strength.

That’s a stalemate.

It’s the kind of weekly candle that screams: “Something’s brewing.”

BTC: No Trend, Just Tension

There’s been no clear directional push all week.

Each attempt higher gets sold off; each dip gets bought up.

That’s textbook equilibrium, the calm before the next move.

And what makes this week special?

We’ve got the FOMC decision coming up.

If you’ve been here long enough, you know the drill:

If we dump before FOMC, we usually pump after.

If we pump before FOMC, brace for a post-meeting fade.

That’s just how liquidity cycles around policy events.

The market prices in expectation, then punishes positioning.

So for now, I’m actually hoping for a flush into FOMC.

Because the best rallies start in fear, not in hope.

Monday Setup: Same Movie, Reverse Order

Funny thing, Monday morning pulled a complete mirror of Sunday.

Went to bed last night with BTC around 92k, woke up at 90k again.

No panic though.

In fact, there’s something I like about this structure.

We’re forming higher lows locally, building a slow grind upward from the bottom region.

It’s not flashy, but it’s constructive.

But there’s one major problem: momentum isn’t backing it up yet.

Momentum Check

On the daily chart, the Stochastic RSI is still hovering at the top, refusing to reset.

That’s a warning sign, it means the market is trying to push up with momentum already stretched.

The weekly and monthly Stoch RSI have reset, which is good.

But until daily resets and curls back up, every short-term rally is suspect.

It’s like driving uphill with the tank already half empty.

You might make it, but one slip, and you roll back down fast.

On-Chain and Derivative Snapshot

Let’s break down the key metrics driving this week’s chop:

CVD Spot: down

CVD Perps: down

This means spot buyers aren’t leading, and perp traders are fading strength.Open Interest: small bounce to around $28.2B

Not enough conviction to call it new positioning.

It’s traders nibbling, not committing.Funding rates: slightly negative across most venues

Shorts are leaning in, but not heavily.

That’s usually when squeezes happen, not full reversals.Arkham flows: still net red over 7 days, meaning more coins moving to exchanges than off.

However, today’s outflow pace has slowed, showing potential stabilization.

Now combine that:

Price up, but CVD down.

That’s the key.

It means the move isn’t driven by real buyers, it’s a liquidity squeeze, not demand strength.

This kind of move typically happens when shorts are overexposed, and market makers push price just enough to trigger stops before fading it again.

So unless we see CVD reversal (buying pressure increasing with price), this is not sustainable upside.

If BTC manages to break 92k while CVD still trends lower, that’s your signal

→ It’s a short-term squeeze, not a trend reversal.

Market Interpretation

We’re stuck in this zone between boredom and disbelief.

People are tired of waiting for direction, but that’s exactly when the biggest moves form.

Volatility compression is opportunity loading.

And make no mistake, liquidity is still thin.

A 2% move can still liquidate half a billion in overleveraged positions right now.

So while everyone is screaming about sideways action, I’m watching for the reaction to volatility, not the volatility itself.

We don’t trade noise, we trade intent.

And right now, intent is hidden under layers of manipulation.

My Playbook

Here’s how I’m navigating this week:

If we dump pre-FOMC: I’ll start scaling in near 85k–87k, especially if CVD turns green.

That’s the zone where liquidity clears and momentum resets.

If we pump into FOMC: I’ll take profit and reduce exposure before the announcement.

The market will likely fade that move right after Powell speaks.

Watch the CVD + Funding combo.

If both flip positive post-FOMC while price holds above 92k, that’s the first real signal of buyer strength returning.

Stay unemotional.

Everyone wants the next leg up, but if you can stay neutral while others chase noise, you’ll catch the move when it matters.

BTC’s current move looks like a liquidity game, not a real trend.

Price up, CVD down, funding negative, flows weak, it’s not conviction yet.

But structure-wise, the higher lows and slowing outflows mean we might be nearing the end of the shakeout phase.

The setup for a real reversal is forming, we just need CVD to confirm it.

Until then, patience is a position.

That’s my BTC breakdown for today.

I’ll go deeper into ETH and SOL setups, funding structure, and whale positioning on Arkham inside the 9-5 Traders Discord.

Join Premium now, full access to real-time updates, liquidity maps, and my trade execution logs.

Don’t trade blind through FOMC week.

Victor