Let’s get straight into it.

No BS.

I know you have been waiting for this all week.

BTC

Nice reaction off support.

Up 4k since our last update, but let’s not get ahead of ourselves.

We’re not out of the woods yet.

We filled 50% of that long wick and bounced cleanly off the lower range support, exactly as planned. That’s what a structured reaction looks like, not noise, not random. Controlled, calculated.

The next major line in the sand is 115.8k.

A close above that level confirms a break of structure and opens up room for continuation to the upside. Until then, treat every pump with patience, not euphoria.

I know some of you are feeling it, that mix of relief and hesitation. You’ve seen the red candles, the social media fear, and the “it’s over” posts.

Remember this feeling.

This is the feeling that the market wants you to have.

The market feeds on your reactions.

If you buy into fear and sell into strength, you’re donating to those who don’t.

If you do what everyone else is doing, you’re the liquidity.

This is where you grow as a trader, not by guessing tops and bottoms, but by recognizing how easily emotions get manipulated.

Fear always hits hardest before regret.

Mark that down somewhere visible.

Reddit’s Top Stocks Beat the S&P by 40%

Buffett-era investing was all about company performance. The new era is about investor behavior.

Sure, you can still make good returns investing in solid businesses over 10-20 years.

But in the meantime, you might miss out on 224.29% gainers like Robinhood (the #6 most-mentioned stock on Reddit over the past 6 months).

Reddit's top 15 stocks gained 60% in six months. The S&P 500? 18.7%.

AltIndex's AI processes 100,000s of Reddit comments and factors them into its stock ratings.

We've teamed up with AltIndex to get our readers free access to their app for a limited time.

The market constantly signals which stocks might pop off next. Will you look in the right places this time?

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

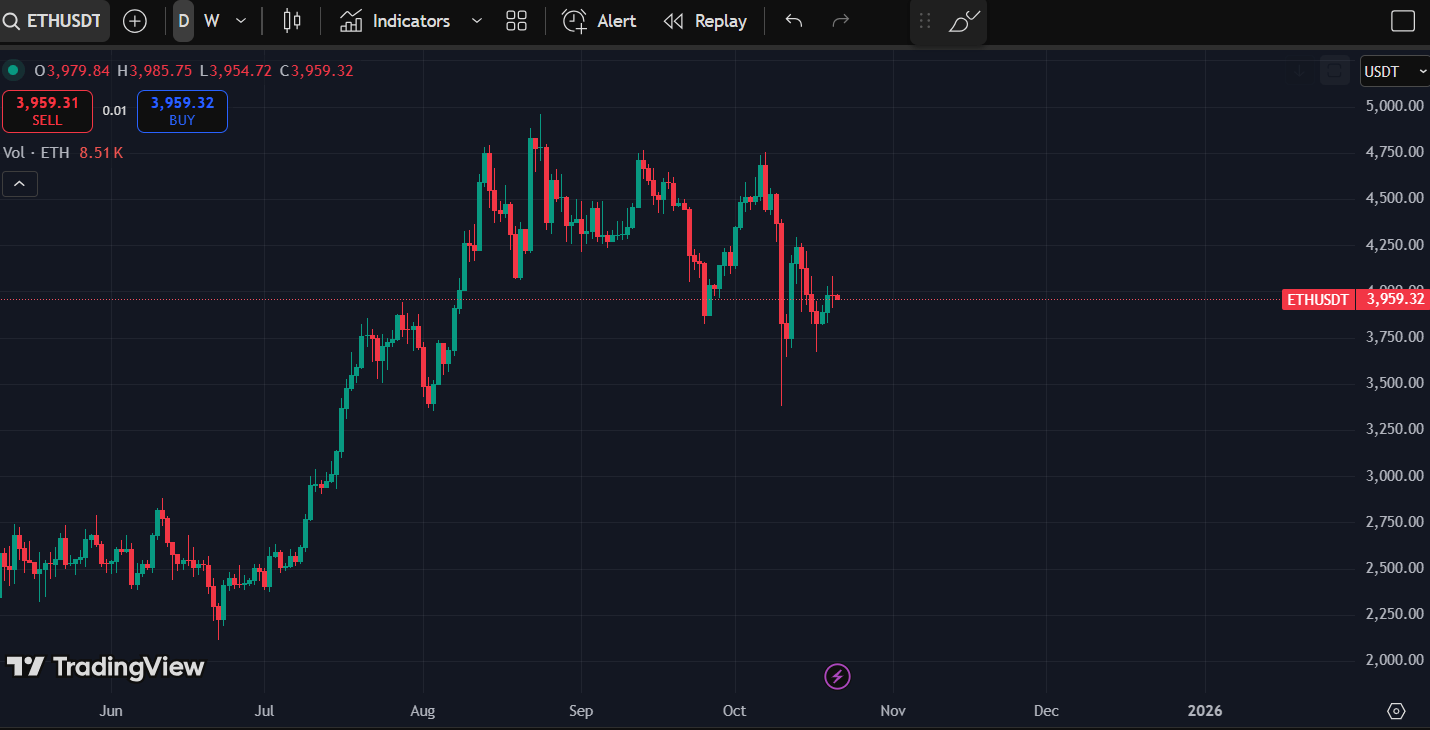

ETH

We’re still coiling up.

Break of structure remains at 4.3k.

As of now, ETH is still gathering momentum, Stoch RSI is curling up beautifully, suggesting a recovery leg is brewing.

Price is hovering around the 4k region, within that familiar range between 3.4k to 4.9k.

This is healthy consolidation after volatility. It’s the kind of structure that builds a base for the next leg.

FUD and bearish chatter are starting to rise again across socials, that’s your sentiment gauge confirming accumulation, not capitulation.

Don’t overthink this phase.

Stick to the plan.

We added at 3.5k and 4k for a reason.

This is where conviction is tested. While retail overanalyzes short-term noise, we accumulate, prepare, and wait for confirmation.

Our job isn’t to predict every candle, it’s to position where risk-to-reward remains asymmetric.

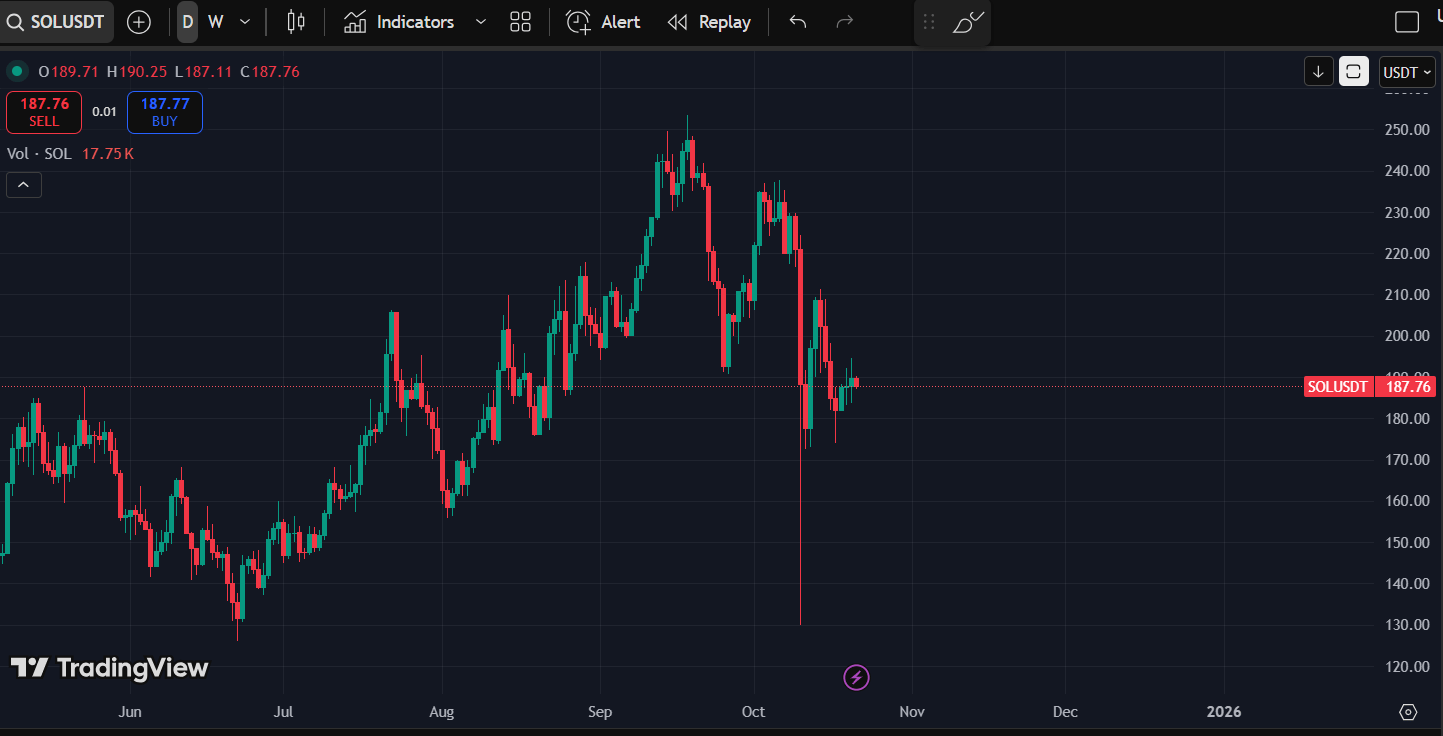

SOL

Perfect textbook reaction.

Pulled back into the support-DCA zone, got aggressively bought up into the US session.

Exactly what we wanted.

If you panicked during that intraday dump, that’s your signal to work on your trading psychology. And that’s fine. Everyone starts somewhere. But understand this: the market will always test your composure before rewarding you.

If you bought when SOL dipped to the 180–192 range, good job.

You bought fear, not hype.

Now the Stoch RSI is curling up, suggesting the next impulse is being prepped.

However, strength here depends on BTC and ETH, they are the drivers. SOL will follow momentum once majors confirm their structure.

So don’t chase; let it play out.

Patience is a position.

TAO

If you’ve been following the plan, you nailed this.

We entered around 299,

took profit around the 450,

then re-entered around 400 once the trendline flipped.

Now price sits near 425, consolidating under that same resistance zone.

If you executed all that, good job. You didn’t just make profits. You demonstrated discipline.

That’s rarer than any signal.

If you didn’t, reflect.

What held you back?

Was it hesitation? Lack of conviction?

Or maybe overexposure elsewhere?

There’s no shame, but there is a lesson.

Right now, TAO is a no-trade zone.

The only valid setup ahead is a breakout above the resistance but that’s a riskier trade than our earlier entries.

If you’re already holding from lower, trail your stop loss into profit territory. Don’t round-trip your gains. Protect them.

This is where you let winners run while defending your base capital.

Final Take

Everyone wants to be “early.”

But the truth is, being early doesn’t matter if you can’t hold through volatility.

What matters more is positioning right, not first.

We’re not in this market to be perfect; we’re here to play probabilities, read emotions, and stay on the right side of the macro cycle.

BTC structure will guide the next phase.

ETH will confirm rotation strength.

SOL and TAO are where the asymmetry lies.

Before it’s too late..

We’re in the middle of a transition phase, the kind that defines portfolios for the next leg of the cycle.

The full Altseason Playbook, Crypto Exit Manual, and Discord strategies are now bundled for $137, for now.

But I’m warning you, I’ll be adding more modules as altseason unfolds.

Once that happens, the price goes up again.

Don’t sit out the best rotation setup of this cycle.

Join now, position smart, and stop trading blind:

Access the Full Package for $137

Victor