Let me tell you a little secret:

Everyone talks about buying early to catch the next 100x.

But the real alpha?

It’s watching the whales accumulate.

And before we dive deep in,

Look.

XRP did a massive run today.

But what if I told you this was all in the charts?

Way back on 25th Dec 24 Xmas?

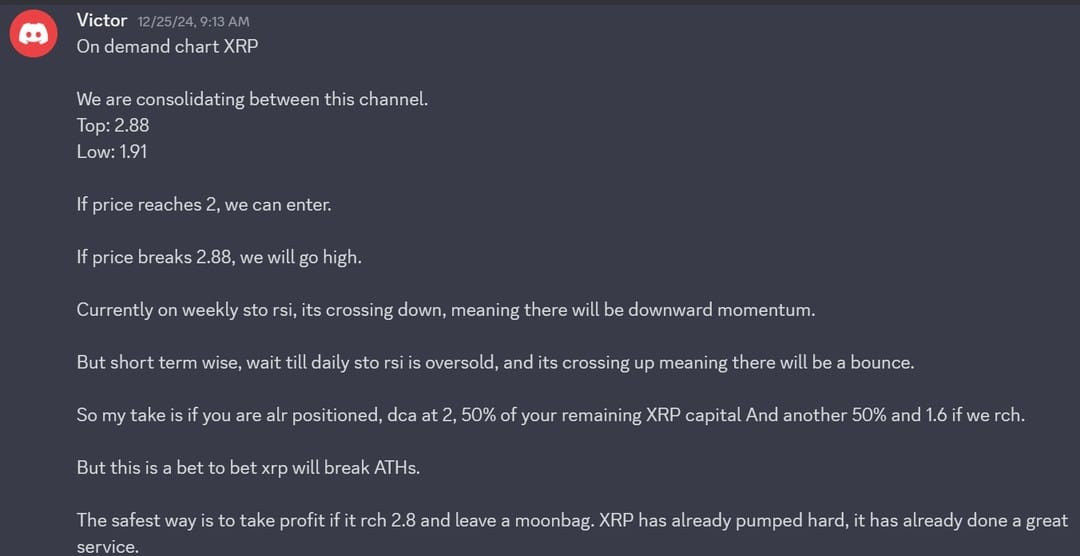

I told my 9-5 Traders group to enter at 2 (this was our 2nd entry, we entered way earlier at 15th Nov 24)

And now we are at $3 XRP.

Buy when nobody is buying.

Sell when everyone is selling.

That's how you win.

That's what I will DRIVE into your trading mindset in 9-5 Traders.

You are missing out if you aren’t inside.

We are way ahead of the retail.

You are missing out.

Read on to join the group.

Why Track Whales?

Whales don’t FOMO. They don’t chase pumps like retail does.

Instead, they quietly accumulate before anyone else notices.

While you’re busy panic selling or jumping on trends too late,

they’re building massive positions in coins you’ve never even heard of.

The best part?

You can track them.

Yes, it only takes 2 minutes to find out:

What whales are holding.

How much they’re holding.

And when they’re buying.

This isn’t a theory.

I’ve used this strategy to find multiple 100x coins.

Now, I’ll show you how to do it step by step.

Step-by-Step Guide to Tracking Whales

Here’s how you do it:

Go to Solscan.io

This is a blockchain explorer for Solana. It lets you dive deep into token transactions.Search for a Large Solana-Based Project

For example, type in a project like $RAY or $TULIP.Scroll to the Token’s Transactions

Here, you’ll find a list of wallets actively transacting with the token.Click on a Large Wallet Address

Focus on wallets that show frequent or high-value transactions.Analyze Their Holdings

Inside the wallet, you’ll see everything they hold—from the major coins to their smallest, riskiest plays.

What You’ll Discover

Here’s an example of what you might see in a whale wallet:

$2.1M in $ABC (their top position, indicating confidence in stability)

$780K in $SOL (a blue-chip holding for safety)

$500K in $SEI (a solid mid-cap)

$450K in Smaller Coins (these are the high-risk, high-reward plays)

Notice the pattern?

The Secret to Whales’ Strategy

Whales aren’t like retail traders.

Large Positions = Safe Bets

Their top holdings are always the coins with the least risk.Smaller Positions = Moonshots

Their small-cap plays are where they take risks for high rewards.

This is where you come in.

By tracking their wallets, you’ll discover the hidden gems they’re betting on.

You can spot the next big thing before it explodes.

How to Use This Strategy

Focus on the Smaller Holdings

That’s where the whales are taking calculated risks.

They’ve done the research—leverage their work, but make your own decisions too.Cross-Reference Projects

If multiple whales are holding the same small-cap coin, that’s a signal.Always Apply Your Own Conviction

This isn’t about blindly following.

Use whale data to refine your watchlist, then do your due diligence.

Example of a Winning Play

Months ago, I tracked a whale wallet on Solscan.

They were quietly accumulating a little-known token: $MARS.

At the time, no one was talking about it.

But I noticed multiple whales holding small positions in the token.

I bought in early, and within weeks, $MARS pumped over 1,000%.

This isn’t luck—it’s strategy.

Why Most People Miss Out

Most traders overcomplicate the process.

They spend hours looking at charts, indicators, and noise.

Meanwhile, whales are buying quietly in the background.

Tracking wallets is simple, but most people are too lazy to do it.

And that’s why they miss out.

The Bottom Line

This market isn’t about being smarter.

It’s about being ahead.

Tracking whales gives you insight into where the real money is moving.

Use this strategy, refine your entries, and watch your portfolio grow.

If you’re serious about learning more,

👉 Join My 9-5 Traders Community

Let me show you how to stop chasing and start winning.

Victor