Everyone sees the candles.

Everyone sees the dips.

Everyone sees the pumps.

But almost no one sees the engine driving all of this:

Bitcoin is now one of the most leveraged assets in human history.

And once you understand what’s happening behind the charts, you’ll understand exactly why every dump feels violent, why every pump feels explosive, why the volatility feels “different.”

Let me explain it to you the way I wish someone explained it to me back in 2017.

The Surge in Leverage Is Not Normal

Look at the first chart.

Trading activity, especially perp trading, has completely exploded.

What used to be dominated by spot players is now ruled by:

hedge funds

HFT desks

quant shops

retail degenerates

market makers

bots

Everyone wants leverage.

No one wants to wait.

This is why a small $2B market order can now trigger a cascade into billions of liquidations.

This is why one candle can teleport price from $105k to $96k in seconds.

Back in 2021, these events were rare.

In 2025?

It’s the norm.

Every single high-volatility moment spikes trading activity to new highs. Dumps especially. That’s when leverage unwinds. That’s when the market reveals who’s naked.

Retail panics.

Funds reposition.

MMs hunt stops.

The entire battlefield shifts in minutes.

The Year-End Moves No One’s Watching

Markets don’t wait — and year-end waits even less.

In the final stretch, money rotates, funds window-dress, tax-loss selling meets bottom-fishing, and “Santa Rally” chatter turns into real tape. Most people notice after the move.

Elite Trade Club is your morning shortcut: a curated selection of the setups that still matter this year — the headlines that move stocks, catalysts on deck, and where smart money is positioning before New Year’s. One read. Five minutes. Actionable clarity.

If you want to start 2026 from a stronger spot, finish 2025 prepared. Join 200K+ traders who open our premarket briefing, place their plan, and let the open come to them.

By joining, you’ll receive Elite Trade Club emails and select partner insights. See Privacy Policy.

Open Interest Proves the Market Is Hyper-Leveraged

This is the part most people ignore.

At the October peak:

Total BTC Open Interest hit levels 5× higher than the 2021 ATH.

Five times.

Do you understand how insane that is?

It means:

more risk,

more fragility,

more cascades,

more forced selling,

more forced buying.

It means the market can go from euphoric to depressed in half an hour.

It means the market can nuke $10,000 in minutes without any real selling — just liquidations.

This is not the old BTC market.

This is a weaponized version of it.

And most traders still don’t realize they’re playing a completely different game.

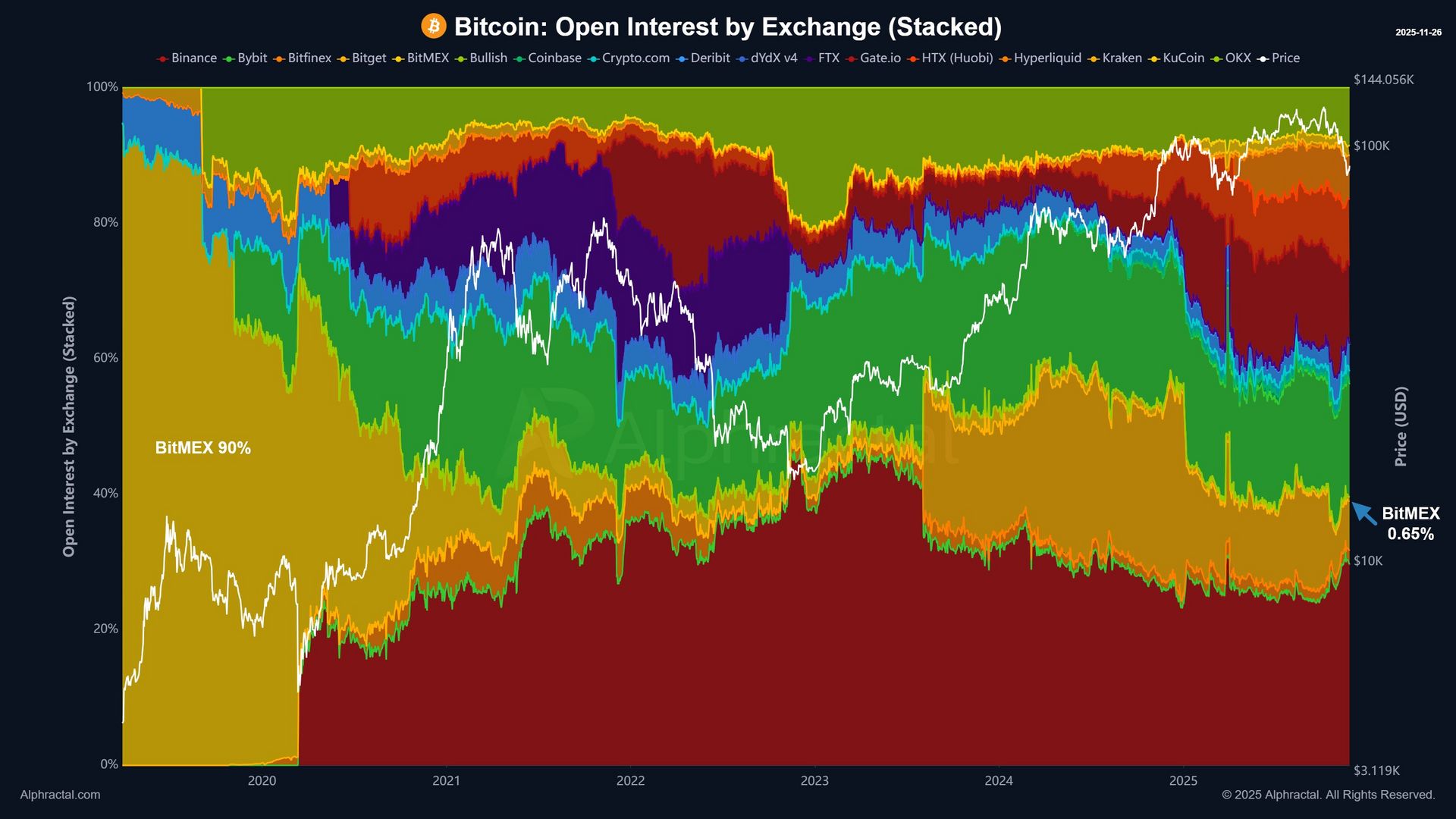

The Exchange Distribution Tells a Story

Years ago, there was BitMEX.

Forget Binance, forget Bybit, forget OKX.

It was a single arena.

BitMEX controlled 90% of leverage trading.

Then came 2020–2023.

Then came advertising.

Sign-up bonuses.

Mobile apps.

100× leverage buttons everywhere.

Today?

BitMEX holds 0.65%.

Now it’s a duopoly:

Binance: 30%

Bybit: 16.7%

And the rest is fighting for scraps.

Remember this:

When exchanges rely on trading fees for revenue, they need you to trade.

They need you to use leverage.

They need volatility.

And guess what?

They got it.

Longs Are Outnumbering Shorts, But That’s Not Bullish

Here’s the part that will shock you:

Longs = 72.4% ($25.72B)

Shorts = 27.6% ($9.79B)

That’s a 2.6× imbalance.

Most traders think:

“Wow, more longs means bullish!”

No.

It means vulnerability.

Historically, short sellers have higher chance of profit because:

markets dump faster than they pump

liquidation cascades wipe longs dramatically

greed keeps longs over-extended

funding flips negative during fear

Why are there so many longs now?

Because everyone is using extreme leverage to chase “one last pump.”

They don’t want spot.

They want instant gratification.

But here’s the cruel truth:

BTC spends more time going up than down,

BUT

leveraged longs die faster than leveraged shorts.

One wick.

One cascade.

One stop-hunt.

Game over.

What This Means for You

When I look at these charts, I don’t see chaos.

I see opportunity.

The entire market is being controlled by leveraged players who are impatient, emotional, and reactive.

They’re not investors.

They’re not strategists.

They’re not disciplined.

They are:

clicking

guessing

panicking

chasing

hoping

And every liquidation cascade we get is the proof.

The truth is simple:

Bitcoin has never been this leveraged.

Bitcoin has never been this fragile.

Bitcoin has never been this explosive.

If you can stay calm in this environment,

if you can position without gambling,

if you can avoid leverage like poison,

if you can follow a plan...

You will outperform 90% of this market.

Easily.

Takeaway

This is not 2021.

This is not 2017.

This is a new era.

A hyper-leveraged market designed to punish the impatient and reward the disciplined.

And the next big move will come not from fundamentals…

…but from the imbalance in leverage.

The liquidations will decide the direction.

Not the tweets.

Not the headlines.

Not the influencers.

The liquidations.

Stay ready.

Stay calm.

Stay disciplined.

Because while everyone else is blowing up their accounts in 50× perps…

You will be preparing for the real wealth transfer.

If you want the framework to survive this market…

If you want the plan I personally use…

If you want the psychology, risk management, and execution…

You already know where this ends.

The next liquidation event will decide who gets rich and who gets wrecked.

Be on the right side.

Victor